The German Catholic “synodal way” has made frequent headlines in recent years, as it has clashed over Church teaching and governance with Pope Francis and the Vatican’s Congregation for the Doctrine of the Faith.

But while the headlines are spicy, the context matters — and understanding the demographics of the Church in Germany may go a long way to understanding some elements of the doctrinal fights.

How does the German church fit in the context of global Catholicism? Why does it seem to place such high priority on married priests, ordained women, and softening unpopular Catholic doctrines? Are the demographics a factor?

The Pillar goes to the numbers:

The Basics

Germany has the fifth-largest Catholic population in Europe, and is home to eight percent of Europe’s Catholic population.

Of the five European countries with the biggest Catholic populations, Germany is the only one in which Catholicism is not the majority faith.

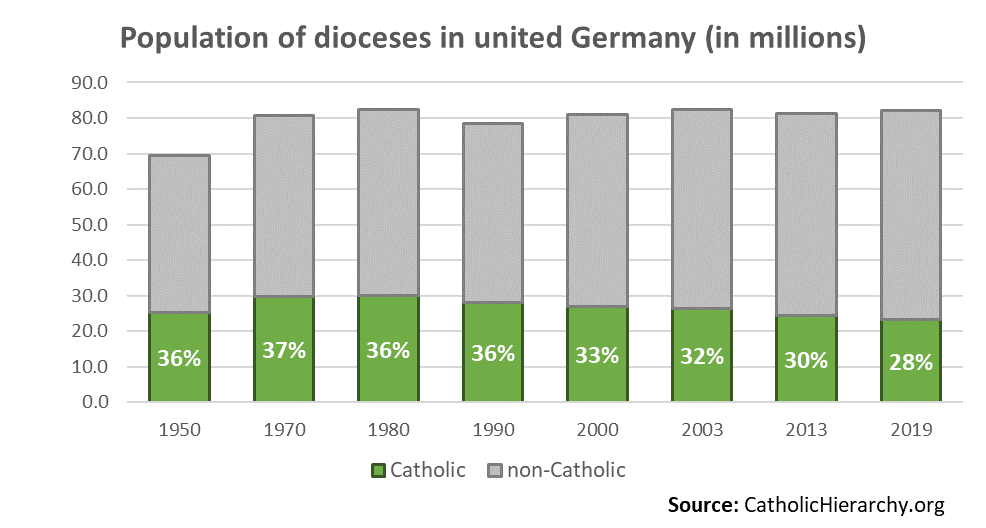

In raw numbers, the Catholic population peaked in 1980 in the dioceses which today constitute modern unified Germany. The Catholic population in those dioceses was 29.9 million in 1980, and has since declined 22%, to 23.3 million.

The population share of Catholics in those dioceses peaked a decade earlier in 1970 at 37%, and since that time has decreased, reaching 28% in 2019.

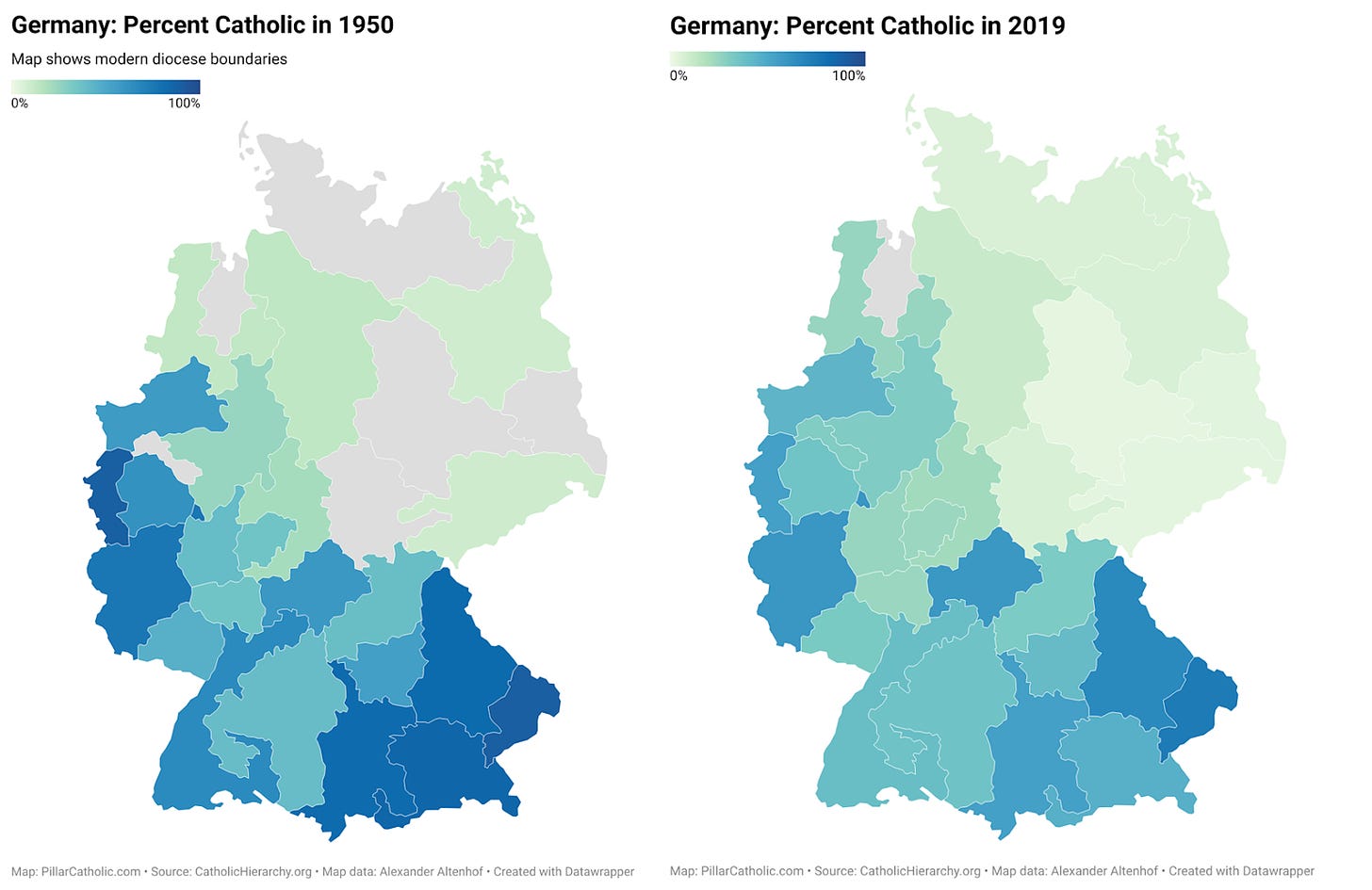

The population share of Catholics varies significantly by region across Germany. Southern Germany has traditionally been a more heavily Catholic area. But some historically Catholic dioceses, such as Munich-Freising and Augsburg, have seen significant declines over the last 70 years.

You can view our interactive map of the changes in Catholic population by diocese here.

The ‘church tax’

To Americans, one of the most surprising aspects of the Catholic Church in Germany is that it receives most of its financial support through the Kirchensteuer, or “church tax.”

This Kirchensteuer is a government administered income tax, distributed to the religious institution to which each taxpayer belongs. The church tax is defined by the German constitution, and is based on similar tax provisions in the 1919 Weimar Constitution and in the 1949 German Basic Law.

A number of other European countries (including Austria, Italy, Switzerland, and Denmark) have state-administered church taxes, but while most of these amount to 1% of income or less, the German church tax rate is set at 8% of income tax liability in Bavaria and Baden-Württemberg and 9% in the rest of the states in Germany — amounts which can sometimes constitute as much as 2% of total income.

Germany also has one of the highest average annual wages in Europe, and a large population. So while Swiss Catholics might have slightly higher average salaries than their German neighbors, for example, Germany’s population is much larger. Having both a relatively large population and relatively high wages ensures considerable revenue for the Church in Germany.

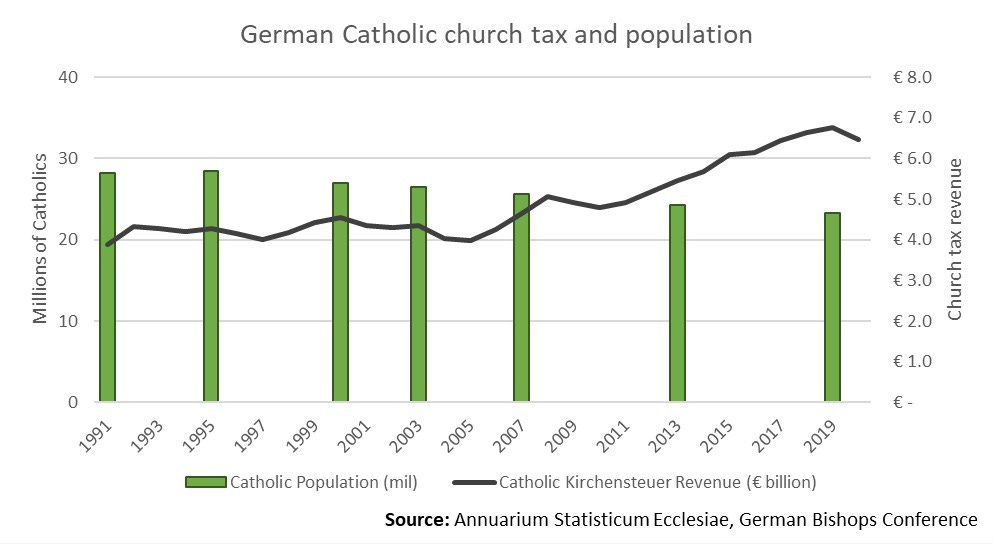

According to reports from the German bishops’ conference, revenues in 2019 from the church tax reached a new high, 6.8 billion euros ($7.7 billion USD).

Although the finances of individual dioceses vary, the Archdiocese of Munich-Freising, seat of Cardinal Reinhard Marx, is typical — 75% of its revenues come from the church tax, and another 15% come from grants, according to 2021 financial statements.

Because of steady increases in the median income of working Germans, the church tax revenues received by the Catholic Church in Germany have increased significantly in recent years, even as the number of Catholics in Germany has decreased.

Because the Catholic Church in the United States is supported by decentralized collections at the parish and diocesan level, and includes many Catholic non-profit organizations which do their own fundraising, it is hard to make a comparison between the funding which the German Church has in comparison to the Church in America.

The average wage in the U.S. is fairly close to that in Germany. But survey results typically suggest that only some practicing U.S. Catholics give even 1% or 2% of their income to the Church, while in Germany, both practicing and non-practicing Catholics are generally paying the Church tax. This means that the German Catholic Church may have as much as four times the financial income per Catholics as the Church in the U.S.

But again, because of the decentralized model for American Catholic fundraising, a direct comparison is very difficult.

It is possible for German citizens to stop paying the church tax, by paying a small fee and filing a form which officially removes their religious affiliation.

But the German Catholic Church has warned that people who are not officially registered with the Church (and thus do not pay church taxes) will see their participation in the Church’s life, even in her sacramental life, limited. A text from the German bishops’ conference says those who opt out are prohibited from Eucharist, from serving as godparents, and can be prohibited from a Catholic funeral.

The Catholic Church in Germany considers the church tax an important part of its identity and function. An FAQ on the German bishops’ website outlines the way the Catholic Church is funded in other parts of the world, but concludes: “None of the other systems of church financing introduced in Europe is able to guarantee the service of the church at the level to which Germany is accustomed, and which continues to be in demand. The church in Germany has been committed to the service of society like hardly any other in Europe.”

A Vocations Crisis

Most countries in Europe and North America have experienced a significant decrease in priestly vocations since the 1960s. Germany is currently experiencing an especially acute period of change. The number of German priests peaked at 26,000 in 1970, and since then has declined by 47%. This is similar to the U.S., where the number of priests has declined by 40% since 1970.

In the U.S., though, that decline has mostly stabilized in recent decades. In the early 1990s, the U.S. saw an average of 458 ordinations a year. From 2015 to 2019, it had 435 per year.

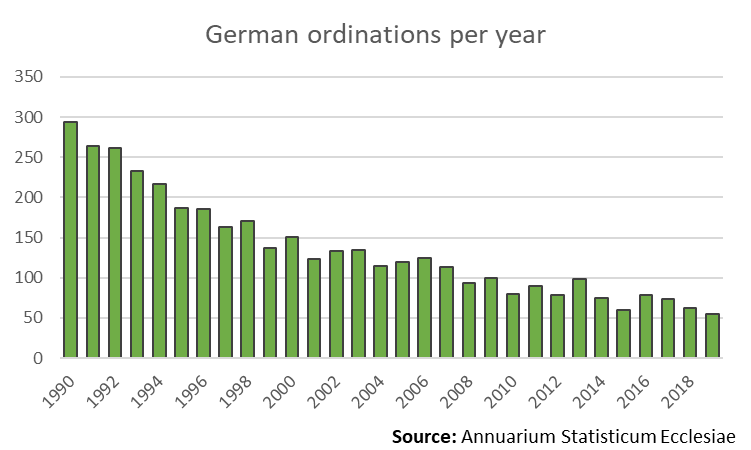

In Germany there has been a continuous and dramatic drop. From 1990 to 1995, Germany averaged 243 ordinations to the diocesan priesthood per year. Over the five years ending in 2019, the average has been just 68, a decrease of 70%.

In 2019, 321 German priests died and another 14 were laicized, while only 55 were ordained. That means that for every new priest gained, six were lost. By comparison, in the U.S., for each new priest 1.4 were lost to death or laicization.

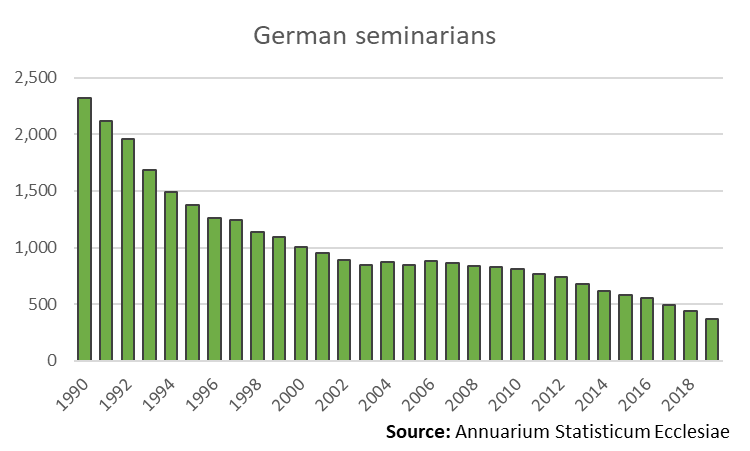

The number of German seminarians has seen a similarly dramatic decline of 70% over the last 30 years, and a 39% drop within just the last five years.

Since the formation of a priest takes about seven years, this suggests that continued decreases in ordinations are likely in the coming years.

These numbers set a stark prospect. Currently there are in Germany 10,122 parishes staffed by 11,246 priests. But given the rate of recent ordinations, in another 40 years the German Church may have only 2,000 to 3,000 priests.

Analysis

While it would be a mistake to attribute all of the changes proposed in the “synodal way” to worldly concerns, the numbers do suggest certain perspectives on the synod’s priorities.

The German Catholic Church is well-funded, experiencing a growth in revenues as the income of German workers grows. It is also, as the bishops’ conference states, “committed to the service of society like hardly any other in Europe.”

But the Church in Germany also faces two sets of incentives which set it apart from the institutional Church in many other parts of the world.

First, because the German Church is funded by the church tax, the key risk to its funding is that people will formally file paperwork to remove themselves from the Church.

Families who attend Mass every week and believe everything that the Church teaches do not necessarily provide the Church in Germany with any more financial support than families who only enter a church for weddings and funerals. This is a significant contrast with regional churches supported primarily by voluntary offering, which often comes disproportionately from the most involved members of the parish.

While some commentators express concern that conservative elements of U.S. Catholicism have undue influence on the bishops because they support the Church financially, for the German bishops the financial risk is different: that someone who is already little involved in the Church will become sufficiently alienated from Catholicism as to file paperwork, pay a 30 euro fee, and be officially disaffiliated.

Second, although the German Church is seeing now a trend of increased revenue, it is in the middle of a vocations crisis which could see it close 80% of its parishes during the next 40 years. For an institutional church which is well-provided with funds and accustomed to providing very well-funded ministry to society, that may seem an unacceptable obstacle.

Broadly speaking, the controversial initiatives of the “synodal way” fall into three categories.

First there is acceptance for relationships and lifestyles contrary to traditional Catholic teaching, including remarriage, same-sex relationships, and intercommunion with other faiths. It seems possible that those priorities would fit well with an aim of reducing the number of citizens who file paperwork to remove their Catholic affiliation for the church tax.

Second is a broadening of the eligibility for orders, so that married men and women could become priests. That would directly address a vocations crisis which threatens to limit the number of clerics in a church with plummeting vocations.

Third is a move toward greater lay control of parishes and of Catholic institutions generally. That aim is another way to address the vocations crisis, providing the German Church with people to serve in the institutions which it sees in the future it may be able to fund but not to staff.

It is beyond the scope of this analysis to conclude that the pressing demographic realities of the Church in Germany are setting its theological and ecclesiastical agenda. But given the conditions, it is not impossible to imagine that the trajectory of the numbers might well be in the minds of at least Germany’s most “forward-looking” Church leaders.

Ed. note: This report originally said the 2019 Church tax was 6.8 million euro, rather than billion. The error was corrected swiftly.